Fundamental Questions About Estate Planning

Key Takeaways

- A wealth plan is a strategic framework that outlines how you plan to manage, grow, and preserve your financial resources over time.

- Many people only think of building wealth in terms of investing, but that is only a small piece of the puzzle.

- It’s important to consult with professionals who can help you create a clear, concise plan to help you obtain your financial, personal, and charitable objectives.

Wealth planning is the blueprint for how to make the most significant financial decisions in your life – from when to sell your business or retire to how you want your assets to be maintained and passed down.

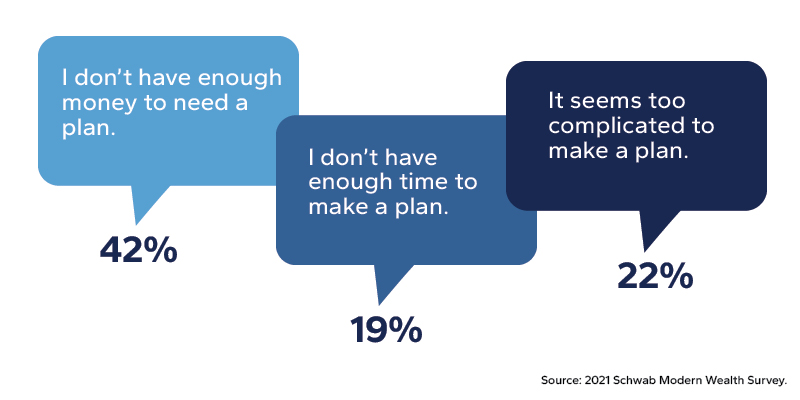

However, only 33% of Americans have a written financial plan, according to Schwab's 2021 Modern Wealth Survey. The same survey revealed that respondents face various roadblocks to creating a financial plan:

It may seem overwhelming to consider how you should be managing your money. But not doing so means you could be missing out on opportunities to grow and protect your wealth. Proactive planning will help you understand your income, expenses, and investments so that you can achieve your goals.

Why is Wealth Planning Important?

A wealth plan is a strategic framework that outlines how you will manage, grow, and preserve your financial resources over time. It’s a personalized roadmap that takes into account your financial goals, values, risk tolerance, and life circumstances while also considering the entirety of your wealth life. This means all of your assets, liabilities, taxes, income, business, and any other aspects of your wealth.

A well-constructed wealth plan encompasses a range of aspects, including investments, taxes, estate planning, retirement, insurance, and more. It is not only built around your goals, but also around your core values.

What matters most to you in life? How does your wealth relate to that? What should your wealth help you accomplish? What could it accomplish for others? These are key questions you’ll need to answer as you consider your comprehensive wealth plan.

Creating a wealth plan can help with the following:

- Clarity of Goals: A wealth plan helps you define and prioritize your financial objectives. It provides a structured approach to achieving short-term and long-term goals, whether it’s buying a home, funding education, or maintaining your current lifestyle throughout retirement.

- Risk Management: A wealth plan includes strategies to help mitigate financial risks. It considers unforeseen events such as medical emergencies or market downturns and prepares you with contingency plans.

- Tax Efficiency: By integrating tax-efficient strategies into your wealth plan, you can likely reduce your tax liabilities and retain more of your wealth.

- Wealth Preservation: Effective estate planning may help ensure that your assets are distributed according to your wishes after your passing. It can also help minimize estate taxes and potential conflicts among heirs.

Key Considerations in Wealth Planning

Communication is Critical

It is never too early to start talking to your children about money.

Protecting your family’s wealth is dependent on open communication.

Follow these steps to ensure that the next generation will be well-equipped to take care of their wealth:

- Teach your children about saving and investing.

- Teach your children how to budget.

- Teach your children about debt, including credit cards, student loans, and interest rates.

- Teach your children about health insurance.

It is important to start talking to your children early so that they grow up prepared to manage their wealth. Set clear expectations about the role your wealth will play in their lives.

Will you pay for their first car? Their insurance? Their college education? Will they receive an allowance? Will you divide their allowance into living expenses, investments, and charitable contributions? It is your job to ensure that you raise financially responsible children who can see the value of their wealth.

Think Long-Term and Adapt When Necessary

Comprehensive wealth planning is long-range. It presents a strategy for the accumulation, maintenance, and eventual distribution of your wealth in a written plan to be implemented and adapted over time. If you aim to build and preserve wealth, it’s important to think about your long-term path.

Many people only think of building wealth in terms of investing – first you invest, then you make money, and that’s how you become wealthy. That is only a small piece of the puzzle.

People who are successful in building and maintaining their wealth take the time to be strategic and plan carefully. They do this to minimize their taxes and debts and adjust their wealth accumulation and wealth preservation tactics in accordance with their personal risk tolerance and changing market climates.

Focus on Estate Planning and Tax Planning Opportunities

Estate planning is a crucial component of your wealth plan because it aims to ensure your assets are distributed according to your wishes either during your lifetime or after your passing. It can also help to minimize gift, estate, generation-skipping, and income taxes.

The best time to start or reevaluate your estate plan is right now. This will help equip your family in case the worst happens, such as a sudden death of a family member or severe mental decline.

Here’s a few reasons why incorporating estate planning into your financial plan is so important:

- Properly implemented estate plans may lower the overall tax burden to your estate.

- Proactive estate planning may allow you to avoid the probate process, which can result in administrative fees to your estate and public filings of your net worth and who will receive your assets.

- An estate plan may help protect your assets from creditor’s claims.

Collaborate with Trusted Wealth Planning Professionals

It’s important to have a team dedicated to helping with the well-being of your wealth and the accomplishment of your personal goals. Your team should include individuals who can help you create a clear, concise plan so that you can increase the probability of reaching your financial, personal, and charitable objectives.

Professionals to consider adding to your financial team include:

Financial Advisor

A financial advisor will review your overall financial picture and coordinate with the rest of your financial team to understand your specific challenges and opportunities. Your financial advisor will also work with you to create a plan that encompasses all aspects of your financial affairs including investment planning, cash and debt management, retirement, risk management, tax minimization, and estate planning.

Tax Professional

A qualified tax professional or Certified Public Accountant will help you navigate complex tax laws, file your family’s business, personal, estate, gift, and trust tax returns, and provide in-depth tax consulting to help minimize the tax burden that will be due each year.

Estate-Planning Attorney

An attorney with expertise in estate planning can help provide your family essential legal documents, such as a will and trusts, entity documents (such as corporations and partnership), and other transfer documents to control who will receive your assets following your passing.

Insurance Specialist

An insurance specialist should work with your financial advisor to make sure that you and your family have considered all the outcomes of an unexpected event. If you have existing insurance policies, the coverage and provisions should be reviewed every three to five years to ensure they are still performing as expected and can meet the intended objectives.

Partner with a Wealth Planning Professional

Think of your comprehensive wealth plan as a compass that may help guide you to long-term success. When you work with Eide Bailly, you'll be surrounded by a team that brings knowledge from an array of specialty areas—business valuation, estate, trust and gift tax planning, financial planning—to provide a comprehensive approach to your wealth plan.

Eide Bailly Wealth

Our advisors are dedicated to understanding your needs and creating a results-driven, relationship-focused approach to your wealth goals.