Key Takeaways

- The 179D Energy Efficient Commercial Buildings Deduction remains available for projects starting construction before June 30, 2026, but will be repealed for later projects due to recent legislation.

- To qualify for the deduction, building owners and designers must begin significant physical work or spend at least 5% of the total project cost before the deadline, and maintain continuous progress.

- Recent legislative changes have increased the potential value of the 179D deduction, but eligibility rules and deadlines are now stricter, making early planning essential.

The Energy Efficient Commercial Buildings Deduction under section 179D has been in place since 2006 to encourage investment in high-performance building design.

179D aims to financially incentivize energy-efficient building improvements, including HVAC, lighting, and building envelope. The deduction rewards building owners and designers who incorporate these types of energy-saving construction measures that lower a facility’s total energy use.

Changes to 179D

There have been significant changes to the 179D deduction over the past several years, including:

- In 2021, the Consolidated Appropriations Act made 179D a permanent part of the U.S. tax code.

- In 2023, the Inflation Reduction Act changed the method of calculating the deduction while significantly increasing the potential deduction amount.

- In 2025, the One Big Beautiful Bill (OBBB) effectively repealed the 179D deduction for all projects beginning construction after June 30, 2026.

Changes to 179D Under the One Big Beautiful Bill

This most recent change in the OBBB means that building owners and their contractors need to begin construction before June 30, 2026, if they hope to be eligible for the 179D deduction.

The Internal Revenue Service recognizes two methods (Physical Work Test or Five Percent Safe Harbor) for determining the commencement date of construction, which must also make continuous efforts toward completion before a specified deadline (Continuity Requirement).

To meet the Continuity Requirement, you must either continuously perform construction activities (under the Physical Work Test) or continuously make efforts to advance towards the facility's completion (under the Five Percent Safe Harbor), barring certain construction disruptions. If a qualified facility is placed in service within four calendar years after the year in which construction begins, the Continuity Requirement is automatically met.

Physical Work Test

The first method of establishing the beginning of construction is the Physical Work Test, which requires “starting physical work of a significant nature.” This includes work performed by the building owner or by other people under a binding written contract and requires that physical work of a significant nature be initiated, demonstrating a clear intent to complete the project. The physical work must be “of a significant nature” and the work must be continuous barring certain construction disruptions.

Physical work of a significant nature includes substantial activities directly related to the project, such as:

- Excavation for the foundation

- Setting of anchor bolts into the ground

- Pouring of concrete pads for foundations

Physical work of a significant nature does not include:

- Planning or designing

- Securing financing

- Exploring

- Researching

- Obtaining permits

- Licensing

- Conducting surveys

- Environmental and engineering studies

- Clearing a site

- Test drilling of a geothermal deposit

- Test drilling to determine soil condition

- Excavation to change the contour of the land

- Demolition and removal of an existing structure.

The Physical Work Test applies to both on-site and off-site physical work. On-site work is considered to have begun when ground is broken on a new facility, such as the excavation for the foundation, setting of anchor bolts into the ground, pouring of concrete pads for foundations, etc.

Qualifying off-site work can include the manufacture of significant components, such as custom HVAC equipment. This work must be performed pursuant to a binding contract, and the eligible equipment cannot be held in the manufacturer’s regular inventory.

Five Percent Safe Harbor

The second method to establish the construction start date is the Five Percent Safe Harbor. Under this rule, construction is considered to have begun if the building owner incurs 5% or more of the total cost of the project, excluding the cost of land or any property not integral to the facility. All other costs included in the depreciable basis of the project are considered. This includes costs such as fees for design, environmental studies, and more.

In the case of manufactured property, the cost is considered incurred when the building owner or taxpayer pays for said property. This means that the costs of equipment and property that are delivered to the site later can potentially apply to the 5% minimum and establish an earlier construction start date.

What Documentation Do You Need for 179D

The following essential records for recordkeeping will aid in establishing the beginning of construction:

1. Essential Project Documents & Permits:

- Construction Contract & Schedule: A legally binding agreement outlining scope, cost, timeline, and payment terms.

- Building Permits: Necessary permissions from local authorities to ensure compliance with codes and regulations.

- Insurance Certificates: Proof of insurance policies, including liability, workers' compensation, and builder's risk.

- Project Plans and Specifications: Detailed drawings and documents outlining the project's design and requirements.

- Site Logistics Plan: Details of site access, material storage, temporary utilities, and safety measures.

2. Initial Site Documentation:

- Pre-Construction Site Survey: Documentation of the existing condition of the site and surrounding properties before work begins.

- Daily Log: Record of daily activities, site conditions, labor hours, equipment used, and any issues encountered.

- Safety Records: Initial safety plans, hazard assessments, and records of safety training provided.

- Material Receiving Logs: Record of materials delivered to the site, including quantity and condition.

- Equipment Inspection Logs: Documentation of pre-use inspections and maintenance records for equipment.

- If equipment is custom manufactured, the contract noting that and documentation showing the order and manufacture dates, along with delivery date

3. Financial Records:

- Project Budget: Detailed breakdown of estimated project costs.

- Payment Schedules: Outline of payment terms and schedule agreed upon with the contractor.

- Purchase Orders: Records of materials and equipment ordered.

4. Communication & Collaboration:

- Initial Communication Logs: Record of important conversations, emails, and meeting minutes.

- Subcontractor Agreements: Formal agreements with subcontractors outlining their scope and responsibilities.

Who Can Take Advantage of Section 179D?

Tax Exempt-Owned Buildings

Buildings owned by tax-exempt entities can allocate the 179D tax deduction to designers of the energy efficient building systems, including the lighting, HVAC, or insulated building envelope. Eligible designers could include architects, engineers, general contractors, and subcontractors, if they have created the technical specifications for the energy efficient building systems. However, a person who installs, repairs, or maintains these building systems would not be eligible.

Projects may have more than one qualifying designer. Therefore, an eligible designer should consider pursuing this deduction as early as possible before another designer claims the deduction.

These Section 179D deductions can be allocated for any project placed in service in a current tax year or the previous three years (assuming the statute of limitations has not closed on any of those years).

Privately Owned Buildings

Privately owned properties placed in service as of January 1, 2006, could benefit from the 179D deduction. The deduction is available for building owners and tenants who pay for and are depreciating the energy-efficient improvements.

Other Types of Organizations

The Inflation Reduction Act made the 179D deduction widely accessible. The deduction is now available to real estate investment trusts and is also open to certain tax-exempt organizations who can allocate the deduction to the “designers.”

Eligible exempt organizations include:

- Federal government

- State or local governments, including public school districts

- Indian tribal governments

- Other tax-exempt organizations, like nonprofit hospitals

Case Study: How 179D Provided a Fortune 500 Company a $26 Million Tax Deduction

For one Fortune 500 manufacturing company, the 179D deduction was a way to make necessary building improvements while realizing significant tax savings. With a 46-million-square-foot portfolio spanning over 350 U.S. facilities, the continual need for maintenance and renovations generated significant tax savings under section 179D.

Here’s how the Eide Bailly Energy Incentives Team has helped them realize a $26,000,000 tax deduction.

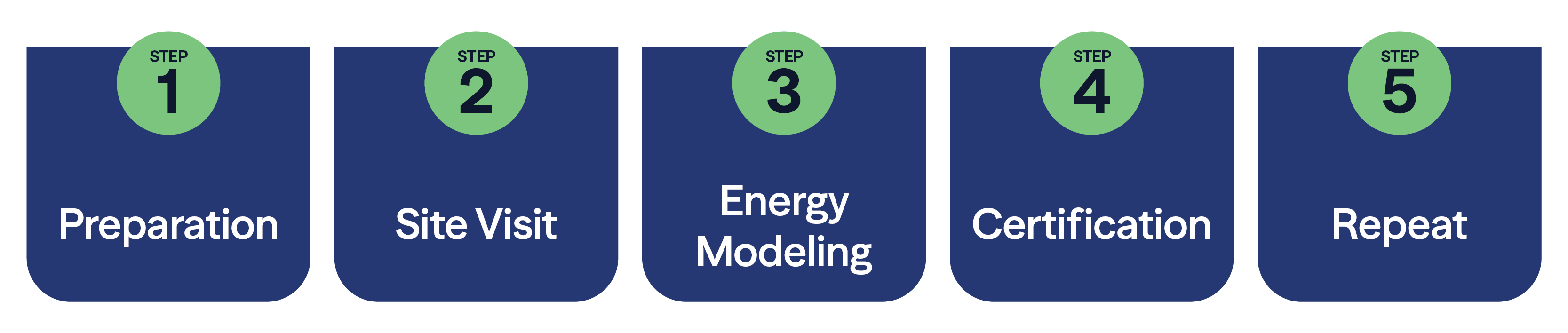

Step 1: Preparation

The team works to aggregate all documentation for a building including plans and specifications. After reviewing the documents, they schedule a site visit with the facility manager.

Step 2: Site Visit

The goal of the site visit is to verify the energy efficient aspects of the building—including the heating and air conditioning, hot water, ventilation, interior lighting, and building envelope systems. This data is used to ensure the accuracy of the energy model.

Step 3: Energy Modeling

Our energy modelers use Department of Energy and IRS-approved software to create energy models which compare the building energy usage to a reference model and determine if the building has 25% or greater energy efficiency than the reference model (which is required to qualify for the deduction).

Step 4: Certification

Our Professional Engineers provide a certificate of compliance. The certificate of compliance is then attached to Form 3115 and submitted to the IRS, where an adjustment is made to reflect the deduction.

Step 5: Repeat

Each building is subject to the same process. Because of the extensive portfolio, this project has been divided into several phases, and the future phases will generate additional tax savings.

Next Steps for 179D in 2026 and Beyond

As the June 30 deadline approaches, it is important to plan purchasing decisions and construction timelines to ensure eligibility for the 179D deduction. With incentive amounts of up to $5.94 per square foot, this deduction can provide a significant boost to your tax strategy if you are building or renovating a facility.

If you have a new or remodeled building or are a qualified designer for any tax-exempt entities, our Energy Incentives team can help.

Frequently Asked Questions

What is the Section 179D energy tax deduction?

Internal Revenue Code Section 179D allows a deduction per square foot for energy-efficient commercial building property (EECBP), including interior lighting, the building envelope, and mechanical systems.

How much is the Section 179D energy tax deduction worth?

179D allows for a deduction of up to $1.88 per square foot for properties placed in service before 1/1/2023 and up to $5.00 per square foot for projects placed in service between January 1, 2023, and December 31, 2032. This deduction is indexed to inflation, so projects completed in 2026 can earn up to $5.94 per square foot.

The base deduction rate for 2023 starts at 50 cents per square foot for 25% improvement against a baseline model and increases incrementally to $1 per square foot for 50% improvement.

A bonus deduction is available for projects that meet prevailing wage and apprenticeship requirements. This bonus deduction starts at 2.50 per square foot and increases 10 cents for each percentage improvement up to $5 per square foot.

What types of improvements qualify for 179D?

Energy‑efficient commercial building property (EECBP) may include upgrades to HVAC systems, interior lighting, building envelope improvements, and other systems that reduce total energy and power costs. Eligible improvements must meet specific energy‑efficiency thresholds established by the IRS.

How do I document that construction began before the deadline?

Acceptable documentation may include construction contracts, schedules, invoices, engineering plans, site surveys, daily logs, equipment orders, and records of physical work performed. This evidence helps establish compliance with the Physical Work Test or the Five Percent Safe Harbor.

Can tax‑exempt organizations benefit from 179D?

Yes. Under expanded rules, many tax‑exempt organizations can allocate the deduction to eligible designers, including schools, hospitals, tribal governments, and nonprofit entities.

How does the 179D deduction interact with other tax incentives?

Projects may qualify for multiple incentives, but coordination rules apply. For example, deductions under 179D cannot overlap with certain credits for the same costs. Taxpayers often evaluate 179D alongside 45L, 45X, or renewable‑energy‑related incentives to maximize overall benefit.

What should building owners consider when planning 2026 projects?

Owners should evaluate construction timelines, material procurement, and design milestones now to ensure they meet the June 30, 2026 deadline. Early coordination with contractors, designers, and tax advisors is critical.

Stay Up to Date

Business Credits & Incentives

Who We Are

Eide Bailly is a CPA firm bringing practical expertise in tax, audit, and advisory to help you perform, protect, and prosper with confidence.